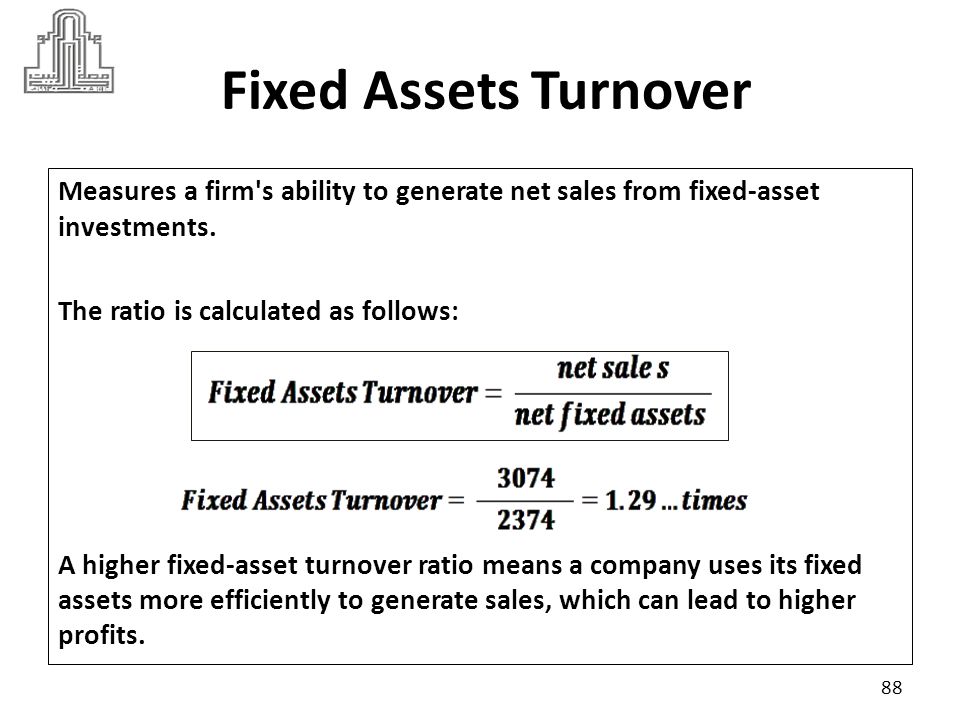

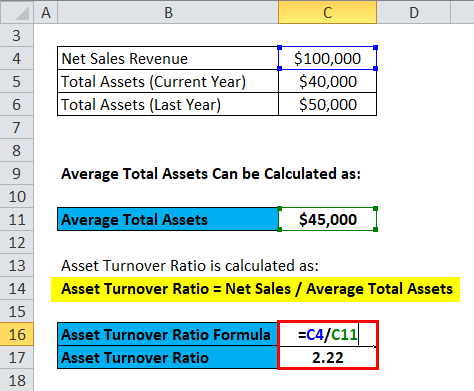

They are considered as long-term or long-living assets as the Company utilizes them for over a year. And we will also include intangible assets Intangible Assets Intangible Assets are the identifiable assets which do not have a physical existence, i.e., you can't touch them, like goodwill, patents, copyrights, & franchise etc. That means we would be able to take current assets under total assets. At the same time, we will also include assets that can easily convert into cash. Plant and machinery, land and buildings, furniture, computers, copyright, and vehicles are all examples. That means we will include all fixed assets Fixed Assets Fixed assets are assets that are held for the long term and are not expected to be converted into cash in a short period of time. What would we include in total assets? We will include everything that yields a value for the owner for more than one year. If you have been given a figure of “Gross Sales” and you need to find out “Net Sales,” look for any “Sales Discount” or “Sales Returns.” If you deduct the “Sales Discounts / Returns” from the “Gross Sales,” you would get the figure of “Net Sales.” read more.” This “Net Sales” comes in the Income statement, and it is called “operating revenues” for the company for selling its products or rendering any services. When you calculate a ratio using “Sales,” it usually means “Net Sales” and not “ Gross Sales Gross Sales Gross Sales, also called Top-Line Sales of a Company, refers to the total sales amount earned over a given period, excluding returns, allowances, rebates, & any other discount. There are a few things you should know before we can go to the interpretation of the ratio.įirst, what do we mean by Sales or Net sales, and what figure would we take to calculate the ratio? What are total assets, and would we include every asset the firm has, or would there be some exception?

Then the asset turnover of Wal-Mart would be precisely (US $523.96 billion / US$228.1 billion) = 2.29xĪsset Turnover Ratio Formula = Sales / Average Assets So to calculate the average total assets, we need to take the average of the figure at the beginning of the year and of the figure at the end of the year, i.e. And its total assets were US $219.30 billion at the beginning of the year and US $236.50 at the end of the year. On 31 st January 2020, Wal-Mart had US $523.96 billion total revenues. It’s being seen that in the retail industry, this ratio is usually higher, i.e., more than 2. The higher the number the better would be the asset efficiency of the organization. And this revenue figure would equate to the sales figure in your Income Statement. In simple terms, the asset turnover ratio means how much revenue you earn based on the total assets. Any of these managing-the-balance-sheet moves improves efficiency.Asset turnover ratio is the ratio between the net sales of a company and total average assets a company holds over some time this helps in deciding whether the company is creating enough revenues to make sure it is worth it to hold a heavy amount of assets under the company’s balance sheet. If you can increase sales while holding assets constant (or increasing at a slower rate), total asset turnover rises.

If you can cut average receivables, total asset turnover rises. If you can reduce inventory, total asset turnover rises. Total asset turnover gauges not just efficiency in the use of fixed assets, but efficiency in the use of all assets. (Excerpts from Financial Intelligence, Chapter 24 – Efficiency Ratios) Total Asset Turnover is calculated by dividing revenue by total assets:įor example, if a company’s revenue was $368,689,295 and its total assets was $245,193,936 then its total asset turnover is: This includes cash, receivables, inventory, property, plant and equipment as well as other long-term assets. This ratio tells you how many dollars of revenue (the value) your company gets relative to the amount invested in total assets, not just your fixed assets.

0 kommentar(er)

0 kommentar(er)